Business Insurance in and around Atlanta

Get your Atlanta business covered, right here!

Cover all the bases for your small business

This Coverage Is Worth It.

Whether you own a a HVAC company, a lawn care service, or an art gallery, State Farm has small business coverage that can help. That way, amid all the different options and decisions, you can focus on navigating the ups and downs of being a business owner.

Get your Atlanta business covered, right here!

Cover all the bases for your small business

Keep Your Business Secure

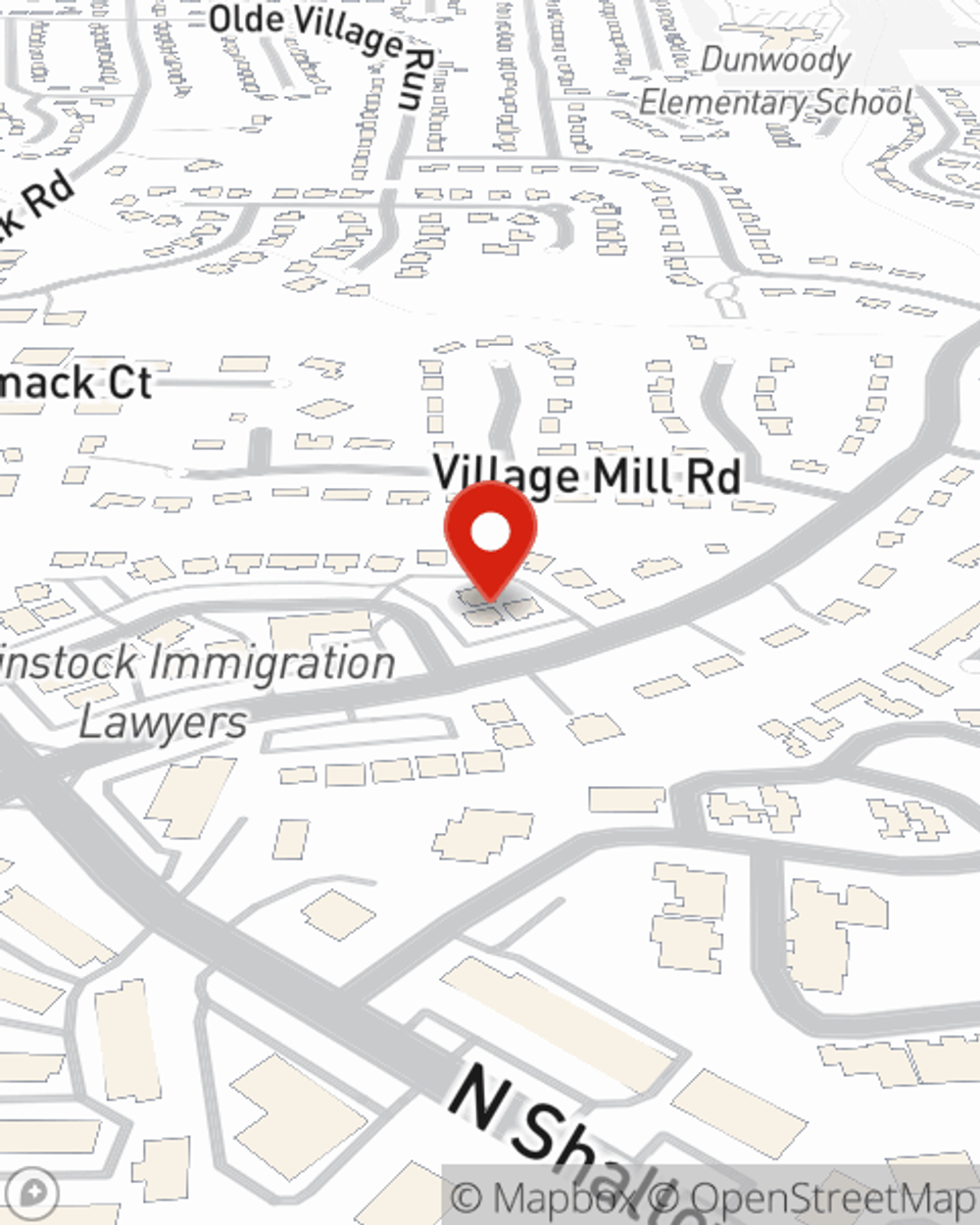

The passion you have to be a leader in your field is a great foundation. When you add business insurance from State Farm, you can be ready for the challenges ahead. That’s why entrepreneurs and business owners turn to State Farm Agent Mark Harden. With an agent like Mark Harden, your coverage can include great options, such as business owners policies, worker’s compensation and artisan and service contractors.

Let's talk business! Call Mark Harden today to discover why State Farm has been rated one of the top overall choices for insurance coverage by small businesses like yours.

Simple Insights®

What are typical landlord maintenance responsibilities?

What are typical landlord maintenance responsibilities?

As a landlord, there are certain maintenance responsibilities associated with the property. Equip yourself to better address repairs while minimizing preventable issues.

How to grow your small business

How to grow your small business

Growing a small business takes strategic planning and research. Consider these helpful tips on ways to grow a small business to help ensure future success.

Mark Harden

State Farm® Insurance AgentSimple Insights®

What are typical landlord maintenance responsibilities?

What are typical landlord maintenance responsibilities?

As a landlord, there are certain maintenance responsibilities associated with the property. Equip yourself to better address repairs while minimizing preventable issues.

How to grow your small business

How to grow your small business

Growing a small business takes strategic planning and research. Consider these helpful tips on ways to grow a small business to help ensure future success.